How Dostocks Work

Contents

That $100 stock with a $4 dividend might decline to $90 per share. With that same $4 dividend, the yield would become just over 4.4%. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Market makers buy and hold shares and continually list buy-and-sell quotations for shares.

- Instead, as a beginner, you should sum up the entire situation and possibilities and plan a strategy that works over the long term.

- When you risk your trading health on a single trade, you’re not acting like a professional trader.

- Stocks are a kind of financial instruments that gives the owner a fractional share of the issuing company.

- If a company pays out 100% or more of its income, the dividend could be in trouble.

In https://forexarticles.net/ trading as a beginner, one of your biggest challenges is narrowing your focus. Stock screeners will help, but they can’t make decisions for you. You’ve got to know what you want out of a trade to know what to look for. The real difference between stock trading as a beginner and as a pro is doing your own work. Amateurs go to stock analysts or chat rooms for their trading ideas.

Why Do Companies Issue Stock Dividends?

If you believe the price of QQQ shares will go down, then shorting QQQ, buying a put option on QQQ, and buying shares in SQQQ will all allow you to profit from a move down. When analyzing stock investment options, investors study some figures to determine whether to buy or sell shares. Shares of stock listed for a set dollar amount can be spot on or over or undervalued. Although dividends are only a few percent, having several shares of stock in a particular company can still result in decent gains. Alphabet’s stock is up considerably since I bought it in early 2020.

It’s very high https://forex-world.net/ because the values can change very quickly and dramatically for no apparent reason. Research any investment professional you’re considering hiring to help prevent losing your money through fraud. A full-service broker will cost more but could be worth the price. They will give you professional recommendations based on your goals, risk profile, and budget.

Cons Of Stock Exchange Listing

They have a history of high returns, but they expose investors to a lot of near-term risk, as we saw during the Great Recession and the early days of the COVID-19 pandemic. Online or “discount” brokers like E-Trade, Merrill Edge, or TD Ameritrade charge no fees for trading stocks and small fees for some other purchases such as mutual funds. A new generation of app-based brokers including Robinhood and Acorns also has emerged. This is do-it-yourself investing, making it easy to place trades with a click on your iPhone or Android device. The free services offer no professional or individualized guidance. A stock represents fractional ownership of equity in an organization.

Resources Learn Browse our latest articles and investing resources. Treasuries Put your cash to work with a high-yield Treasuries account. Alternatives Buy fractional shares of fine art, collectibles, and more. The Buttonwood Agreement, so named because it was signed under a buttonwood tree, marked the beginning of New York’s Wall Street in 1792. The agreement was signed by 24 traders and was the first American organization of its kind to trade in securities. The traders renamed their venture the New York Stock and Exchange Board in 1817.

The bottom line on stock markets

You can also consider buying single stocks from a range of companies for a more diverse investment portfolio. The thing about stocks and investing is that it can be incredibly risky but also promises great rewards. If your investment pays off, you can reap amazing rewards, but you can lose everything you invested if things go wrong. You can get active on the stock market with the help of a stockbroker.

Instead, they have preferences when it comes to dividends and assets in case of liquidation. To master stocks 101, you must know that not all common stocks necessarily come with equal rights. Sometimes, to obtain the possibility of the owners controlling their wealth, some companies have several classes of common shares.

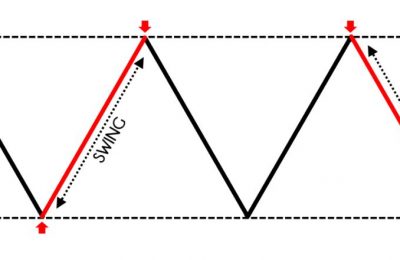

Supply and demand help determine the price for each security, or the levels at which stock market participants — investors and traders — are willing to buy or sell. This process is called price discovery, and it’s fundamental to how the market works. Price discovery plays an important role in determining how new information affects the value of a company. This negotiation process maximizes fairness for both parties by providing both the highest possible selling price and the lowest possible buying price at a given time.

Because when you sell investments in a downturn, you lock in your losses. If you plan to re-enter the market at a sunnier time, you’ll almost certainly pay more for the privilege and sacrifice part of the gains from the rebound. A stock market crash is a sudden, very sharp drop in stock prices, like in early 2020, around the beginning of the COVID-19 pandemic. Bull markets are followed by bear markets, and vice versa, with both often signaling the start of larger economic patterns. In other words, a bull market typically means investors are confident, which indicates economic growth. A bear market shows investors are pulling back, indicating the economy may do so as well.

It is different from a bond, which operates like a loan made by https://bigbostrade.com/ors to the company in return for periodic payments. A company issues stock to raise capital from investors for new projects or to expand its business operations. The type of stock, common or preferred, held by a shareholder determines the rights and benefits of ownership. But building a diversified portfolio of individual stocks takes a lot of time, patience and research. The alternative is a mutual fund, the aforementioned exchange-traded fund or an index fund.

They are reliable, so owning stock from these companies is considered a valuable and safe investment. A new company will usually have only a few shares — between 10 and 100 to a thousand — while larger companies can have millions. The company owners will determine the number of shares to issue by looking at its future growth expectations. Often, people think stocks and shares are the same thing, and they’re almost right. Invest in stocks of profitable companies that sell goods and services that a growing number of people want.

What is stock market volatility?

Because of this beginners should avoid stock trading or actively buying and selling stocks — especially day trading — and focus on long-term buy-and-hold investing. Companies can complete multiple secondary offerings of their stock when they need to raise additional funding, provided investors are willing to buy. Meanwhile, exchanges provide investors with liquidity since they can sell shares among each other. For example, a company’s earnings and its growth prospects can affect its share price. Meanwhile, anything from an upcoming election to how investors feel about the economy’s direction can also impact stock prices. Notable stock market exchanges include the New York Stock Exchange , Nasdaq Exchange, and OTC Markets.

He currently oversees the investment operation for a $4 billion super-regional insurance carrier. People buy stocks to earn a return on their investment, which allows them to grow their wealth and achieve financial goals like retirement. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

In the past, stock markets were placed in public venues, but nowadays they are mostly electronic marketplaces. After mastering how to invest in the stock market, you can make a profit by selling stocks at a higher price when the value of the company goes up. Some stocks also pay dividends, a portion of a company’s profits, usually quarterly. You can pull back and second guess your investments by selling your shares.

When you own a stock, the company’s management team and all its employees work on behalf of shareholders to build value. The company’s board of directors are there to represent the shareholders’ interests and can make changes to management it deems necessary. You’d be much more involved in the day-to-day decision making of a company you owned on your own or with partners.